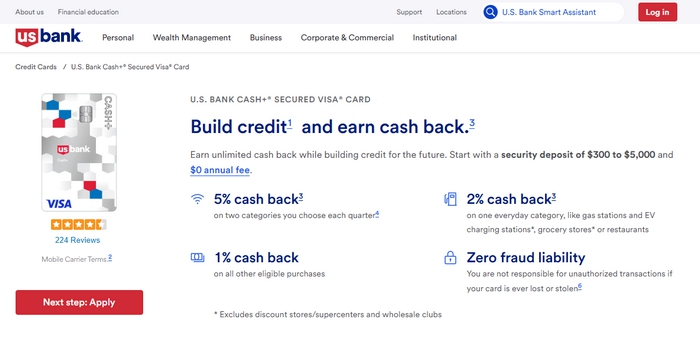

U.S. Bank Cash+ Secured Visa: Everything About Benefits, Fees, and How to Apply

If you’re looking for a way to build your credit without needing a traditional card, the U.S. Bank Cash+ Secured Visa Card might be a great choice. This is a secured card, meaning you make a security deposit to set your credit limit, making it accessible even for those with a complicated financial history.

Advertisement

Plus, unlike other secured cards, it offers cashback rewards, which is a huge advantage for anyone wanting to maximize daily purchases. But is it really worth it? What are the requirements? How does the application process work? Stick with me, and I’ll tell you everything!

Advertisement

Is It Worth Applying for the U.S. Bank Cash+ Secured Visa Card?

If you want to boost your credit score while enjoying benefits like cashback and no annual fees, then yes, it’s worth it! Here are some reasons why this card might be a great choice for you:

- Helps Build Credit – The bank reports your usage to major credit bureaus, helping you improve your score over time.

- Cashback on Purchases – Earn up to 5% cashback on categories you choose every quarter.

- No Annual Fee – Unlike many secured cards, you don’t have to pay a fee just to keep it active.

- Upgrade Option – If you use the card responsibly, you may qualify for an unsecured card in the future.

- Security and Control – Easily manage your spending through the U.S. Bank app.

How to Apply for the U.S. Bank Cash+ Secured Visa

Applying for this card is a simple process and can be done online. Just follow these steps:

Anúncios

- Visit the U.S. Bank website and navigate to the Cash+ Secured Visa card page.

- Fill out the application form with your personal and financial details.

- Choose your security deposit amount, which can range from $300 to $5,000 (this amount will be your credit limit).

- Submit your application and wait for the bank’s review. In just a few days, you’ll receive a response regarding your approval.

- If approved, make your deposit and wait for your card to arrive so you can start using it.

What Are the Requirements to Apply for the U.S. Bank Cash+ Secured Card?

Not everyone can apply for this card, but the requirements are pretty accessible. Here’s what you need to qualify:

- Be of legal age (at least 18 years old in the U.S.).

- Have a valid Social Security Number (SSN).

- Own a bank account in the United States.

- Make a minimum deposit of $300.

- Not have an extremely negative credit history (although they accept applicants with low or no credit scores).

Discover the Benefits of the U.S. Bank Cash+ Secured Card

This card isn’t just another option for building credit – it also offers some great perks. Here are some of the main benefits:

- 5% cashback – Choose two categories per quarter to earn this cashback rate on eligible purchases.

- 2% cashback – Available for grocery stores and gas station purchases without needing to select categories.

- 1% cashback – Applied to all other purchases.

- No annual fee – A great advantage compared to other secured cards.

- Reports to credit bureaus – Helps improve your credit score with responsible use.

Does the U.S. Bank Cash+ Secured Visa Card Have Fees?

While this card doesn’t have an annual fee, there are some fees you should be aware of:

- Interest on outstanding balances: Around 29.24% APR (avoid carrying a balance to prevent high interest!).

- Cash advance fee: 5% of the amount withdrawn or $10, whichever is higher.

- Foreign transaction fee: 3% of the purchase amount made outside the U.S.

Does the U.S. Bank Cash+ Visa Have an Annual Fee?

No! This is one of the card’s biggest advantages. Many secured cards charge an annual fee, but the U.S. Bank Cash+ Secured Visa lets you keep it without this extra cost, making financial management even easier.

What Credit Score Is Needed for the U.S. Bank Cash+ Secured Card?

The good news is that you don’t need a high credit score to get this card. It’s designed for people with:

- Poor credit (300 – 579)

- Fair credit (580 – 669)

- No credit history (ideal for those just starting to build credit in the U.S.)

So even if you’re starting from scratch or have a poor history, you can still get approved.

What Is the Credit Limit for the U.S. Bank Cash+ Card?

Your credit limit depends on the security deposit amount you choose. The minimum is $300, and the maximum can go up to $5,000. This means you have control over your own limit and can adjust it based on your needs.

How to Contact U.S. Bank Cash+ Card Customer Support

If you need assistance or have any questions about your card, you can reach U.S. Bank through the following channels:

- Phone: 1-800-USBANKS (1-800-872-2657)

- International Support: 1-503-401-9991

- Online Chat: Available on the U.S. Bank website

- U.S. Bank Mobile App – Manage your account and access support directly through the app.

If you’re looking for a secured card that truly offers benefits, the U.S. Bank Cash+ Secured Visa might be the right option for you. In addition to helping you improve your credit, it also provides cashback and has no annual fee – something hard to find in this category of cards. If you have a low credit score or are just starting your credit journey in the U.S., this could be the perfect tool to take that first step in the right direction.

Now that you know everything about this card, how about taking the next step and applying for yours?