Blue Cash Preferred American Express Card: How to apply and benefits

Looking for a credit card that truly rewards your spending? The Blue Cash Preferred American Express might just be what you’re searching for. With so many cards out there, how do you know if this one fits into your wallet just right?

Advertisement

In this read, you’ll discover the standout features and perks of the Blue Cash Preferred Card. We’ll break down the best ways to earn cashback and help you understand the interest rates and fees. Curious if it fits your lifestyle and spending habits? Let’s dive in and find out.

Advertisement

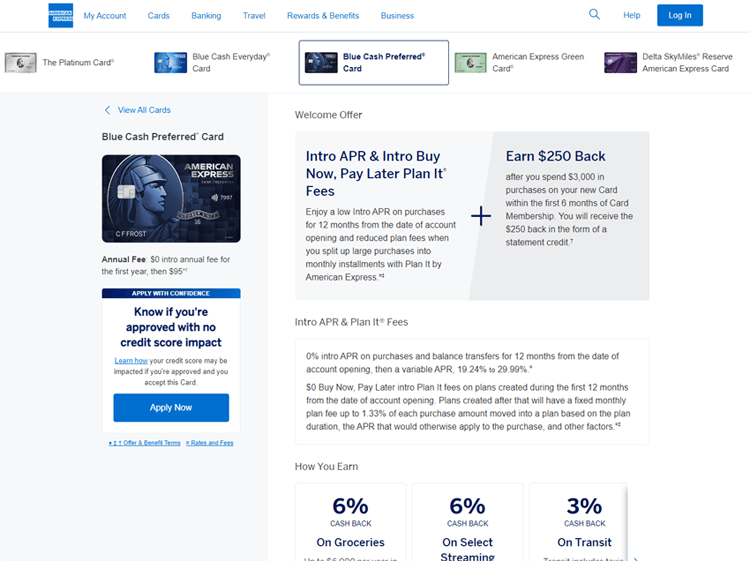

How to apply for the Blue Cash Preferred Card

Applying for the Blue Cash Preferred Card online is simple and quick. You won’t even need to leave your home. Here’s how you can do it without any hassle:

- Visit the American Express Website (www.americanexpress.com);

- Once you’re on the card’s page, look for the “Apply Now” button. Click it, and you’ll be taken to the application form.

- Provide some basic information like your name, address, and income. Double-check what you’ve entered to make sure it’s all correct. This can help speed things up.

- Before hitting submit, go over everything one last time. Ensuring accuracy helps avoid any delays.

- After submitting, you usually get an answer pretty quickly. If you’re approved, you’ll be informed about your credit limit, and you can start using your card.

Requirements to apply for the Blue Cash Preferred card

Applying for the Blue Cash Preferred American Express card online is quick and convenient. You can skip the bank visit and save time by filling out the application at home. Just think how easy it is to apply online in minutes instead of waiting in long lines!

Anúncios

Before starting, have these documents ready:

- Proof of Identity: A driver’s license or passport works.

- Income Information: Recent pay stubs or tax returns will do.

- Social Security Number: This is required for the credit check.

In short, applying for the Blue Cash Preferred Card is a breeze. With these steps and documents in hand, you’re all set for a great credit card experience.

Benefits of the Blue Cash Preferred Card

The Blue Cash Preferred Card is packed with great benefits that can make your daily spending more rewarding. Imagine turning your everyday purchases into cashback opportunities. Let me break it down for you:

- Big Savings on Groceries: You get 6% cashback at U.S. supermarkets, up to a yearly limit. This means every grocery run can help you save money. If you spend $100 a week on groceries, that’s $6 back in your pocket each time!

- Entertainment Rewards: Enjoy streaming your favorite shows? You earn 6% cashback on select streaming services. So, while you’re catching up on the latest series, your card is earning rewards for you.

- Travel Perks: Whether it’s your daily commute or a night out, get 3% cashback on transportation. This includes taxis, rideshares, and public transit. It’s a nice way to earn rewards while getting from point A to B.

- Everyday Purchases: For everything else, you earn 1% cashback. From coffee shops to clothing stores, your card helps you earn with every swipe.

- Kickstart with a Bonus: New to the card? Look forward to a welcome bonus after spending a certain amount in the first few months. It’s a great way to start earning rewards fast.

These benefits make your spending not just a necessity but a way to earn. The Blue Cash Preferred Card helps you get more from places you already shop, making everyday purchases feel more rewarding. Why not let your spending work for you?

Coverage and Acceptance Network

The Blue Cash Preferred® Card from American Express is widely accepted at a vast network of merchants in the United States and internationally. With coverage at millions of merchants, you can use your Card to shop at grocery stores, gas stations, streaming services and more, and enjoy rewards across these categories.

What is the interest rate?

Let’s talk about the interest rate and fees of the Blue Cash Preferred Card. It’s important to know this so you can decide if this card is right for you. First off, the card has an Annual Percentage Rate (APR) that can range from 15.99% to 25.99%. This means if you don’t pay off your balance each month, you could end up paying a lot in interest.

To avoid this, try to pay your balance in full whenever you can. This way, you enjoy the benefits without worrying about extra costs. The card also has a great introductory offer for new users. For the first 12 months, you might enjoy a lower APR, which can help you save a bunch on interest, especially if you need to make big purchases soon after getting the card. It’s like a welcome gift to help you settle in.

Does the card have an annual fee?

Yes, there is a $95 annual fee. It may seem like a lot, but if you take advantage of the cash back rewards, you can easily cover that fee. Think about how much you spend on groceries and streaming services. By maximizing these benefits, you can make the card pay for itself. Have you considered that?

Don’t forget about other potential costs. If you travel and use your card abroad, there is usually a foreign transaction fee of about 2.7% per transaction. Also, be aware of late or returned payment fees. Keeping track of your billing schedule is crucial to avoiding these extra charges.

How often do you check your statements to make sure everything is in order? Knowing the details of your card’s fees and interest rates can make a big difference. Weigh these costs against the benefits to see if this card fits your needs.

How to get in touch

The Blue Cash Preferred® Card from American Express offers a variety of financial benefits that make it an excellent choice for those looking to maximize their returns on everyday purchases. For more information or to contact American Express about the Blue Cash Preferred, you can visit the official American Express website and visit the customer service section.

There, you can find dedicated phone numbers, an online chat for real-time support, and even options to email the support team directly. If you’re already a cardholder, the American Express mobile app also offers a convenient way to manage your account and connect with customer support.

Conclusion

As we wrap up this article, you’ve explored the Blue Cash Preferred Card from American Express, diving into its perks, rewards, and costs. This card stands out with its impressive cashback options on daily expenses, giving you a chance to boost your savings.

Think about how this card could align with your financial goals. Look at your spending habits: could they be earning you rewards? Are you ready to turn your everyday shopping into opportunities for savings? Now might be the perfect moment to make a move towards enhancing your financial well-being!