Learn about the benefits and how to apply for the PenFed card

Advertisement

PenFed Credit Union offers competitive credit cards with generous cashback rewards, low interest rates, no annual fees, and exclusive member benefits, requiring credit union membership but providing exceptional value for cardholders nationwide.

Advertisement

PenFed Card represents one of the most attractive credit card options available through Pentagon Federal Credit Union, the nation’s second-largest federal credit union. With over two million members, PenFed provides credit cards featuring competitive rewards programs, industry-leading interest rates, and member-focused benefits that often surpass offerings from traditional banks. Understanding the application process and card benefits helps you determine whether PenFed membership and their credit cards align with your financial goals.

Anúncios

How to Apply for the PenFed Card

Applying for a PenFed credit card requires two steps: becoming a credit union member and then applying for the card. Unlike traditional banks, PenFed operates as a member-owned cooperative, but membership is now accessible to virtually all Americans through association membership for a small one-time fee.

Membership Eligibility

- Active duty military, veterans, or Department of Defense employees

- Family members of current PenFed members

- Anyone joining a qualifying association like National Military Family Association for twenty dollars

Step 1: Join PenFed

- Visit penfed.org and click Join Now

- Select eligibility category or join qualifying association

- Provide name, Social Security Number, address, and contact information

- Create login credentials and security questions

Step 2: Open Savings Account

- Deposit minimum five dollars to establish membership

- Link external bank account or mail check

Step 3: Choose Your Card

- Power Cash Rewards: 1.5% cashback on all purchases, no annual fee

- Platinum Rewards: 5X points on gas, 3X on groceries

- Pathfinder Rewards: Travel rewards with annual fee

Step 4: Apply for Credit Card

- Log into PenFed online banking

- Navigate to Credit Cards and select your chosen card

- Enter employment information and annual income

- Submit application for instant decision

Step 5: Activate Your Card

- Receive card by mail within seven to ten business days

- Activate online or by phone

- Set up autopay and transaction alerts

- Add to digital wallets for contactless payments

PenFed Credit Card Features and Benefits

PenFed credit cards stand out in the competitive credit card market through generous rewards programs, exceptionally low interest rates, and comprehensive cardholder benefits. Understanding these features helps you maximize card value and make informed decisions about which PenFed card best serves your financial needs.

The PenFed Power Cash Rewards card exemplifies the credit union’s value proposition with unlimited 1.5% cash back on all purchases. Unlike tiered cashback cards requiring mental math about spending categories, this flat-rate rewards structure provides simplicity while remaining competitive with or exceeding many bank card offerings.

Rewards Programs

Each PenFed credit card offers distinct rewards structures tailored to different spending patterns and preferences.

- Power Cash Rewards provides straightforward 1.5% cashback on every purchase without category restrictions or caps

- Platinum Rewards Visa offers 5X points per dollar on gas purchases and 3X points on grocery spending

- Pathfinder Rewards delivers 4X points on airlines and 3X on dining with valuable travel protections

- Points typically redeem at one cent per point for statement credits gift cards or merchandise

- Cashback posts to your account quarterly or upon redemption request with no minimum threshold

- No rewards expiration as long as account remains open and in good standing

Interest Rates and Fees

PenFed consistently offers some of the lowest credit card interest rates in the industry, significantly benefiting members who occasionally carry balances.

- Annual Percentage Rates often start around 10% for qualified applicants with excellent credit

- No annual fees on most PenFed cards except premium travel cards with extensive benefits

- No balance transfer fees on most cards making them excellent for debt consolidation

- No foreign transaction fees enabling cost-effective international purchases and travel

- Late payment fees capped at lower amounts compared to typical bank credit cards

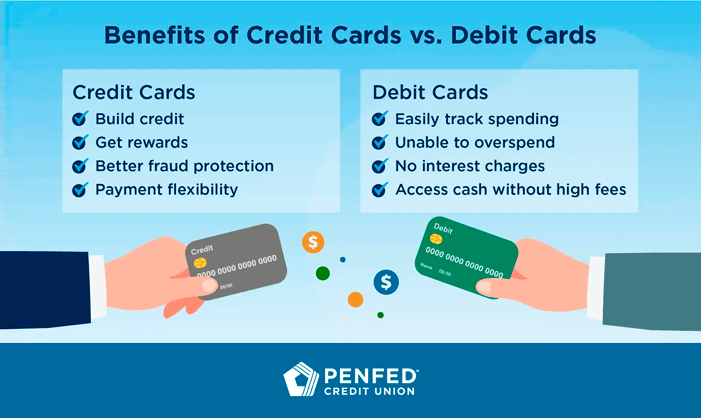

Building Credit with PenFed Cards

PenFed credit cards provide excellent opportunities for building or rebuilding credit through responsible usage and the credit union’s member-focused approach. Regular reporting to all three major credit bureaus ensures your positive payment history improves your credit score over time.

Responsible credit card usage means paying your balance in full each month when possible, keeping utilization below thirty percent of your credit limit, and never missing payment due dates. PenFed’s low interest rates provide a safety net if you occasionally need to carry a balance, though avoiding interest charges entirely maximizes financial benefit.

Credit Building Strategies

- Set up automatic payments for at least the minimum amount ensuring you never miss due dates

- Keep credit utilization low by using card regularly but paying down balances frequently

- Request credit limit increases after six months of responsible usage improving utilization ratio

- Monitor your credit score through PenFed’s free credit monitoring service tracking improvement

- Maintain account long-term as length of credit history positively impacts credit scores

- Avoid applying for multiple credit cards simultaneously which can temporarily lower scores

Credit Monitoring Tools

PenFed provides members with free credit monitoring tools helping you track credit health and identify potential fraud or errors affecting your credit report.

- Free monthly credit score updates showing changes and factors affecting your score

- Credit report monitoring alerting you to new accounts inquiries or significant changes

- Identity theft protection with alerts for suspicious activity on your credit file

- Educational resources explaining credit scoring and strategies for improvement

Maximizing PenFed Card Rewards

Strategic card usage maximizes rewards earnings without changing your spending habits significantly. Understanding how to optimize rewards, combine PenFed products, and take advantage of special promotions increases the value you receive from membership.

Cashback and points rewards accumulate automatically on eligible purchases, but strategic category spending can significantly boost annual earnings. Using the Platinum Rewards card for all gas and grocery purchases while using Power Cash for everything else creates a simple two-card strategy maximizing rewards across spending categories.

Reward Optimization Strategies

- Pay all recurring bills like utilities insurance and subscriptions with your PenFed card earning rewards on necessary expenses

- Use card for business expenses if self-employed earning rewards while simplifying expense tracking

- Take advantage of shopping portal bonuses when available for online purchases

- Combine credit card rewards with PenFed checking account benefits for maximum value

- Redeem rewards strategically timing redemptions for maximum benefit or need

- Stack promotional offers with base rewards during special earning periods

Additional Member Benefits

Beyond credit cards, PenFed membership unlocks access to competitive financial products enhancing your overall financial health.

- Auto loans with rates consistently among the lowest nationally for new and used vehicles

- Mortgage products including competitive rates and special programs for military members

- High-yield savings accounts and certificates with rates exceeding most traditional banks

- Personal loans with flexible terms and competitive rates for debt consolidation or major purchases

- Free financial counseling and education resources for members at all financial stages

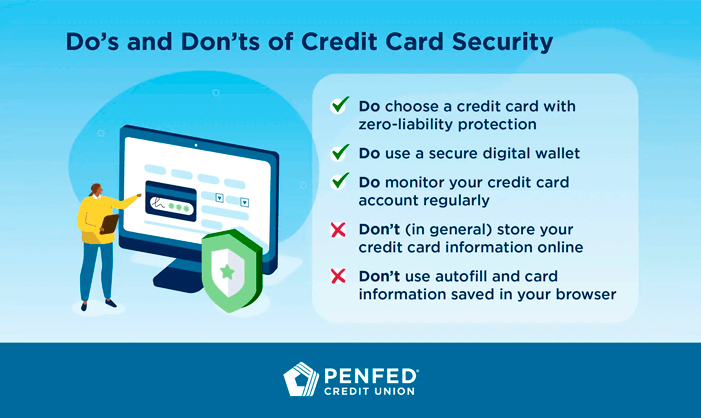

PenFed Card Security and Protection

PenFed implements comprehensive security measures protecting members from fraud while providing peace of mind during transactions. Understanding these protections and how to use them effectively keeps your account secure and minimizes liability if fraud occurs.

Zero liability protection means you’re not responsible for unauthorized charges when reported promptly. PenFed’s fraud detection systems monitor transactions in real-time, often identifying and blocking suspicious activity before you notice anything wrong. These proactive measures combined with your vigilance create multiple layers of protection.

Security Features

- EMV chip technology provides enhanced security for in-person transactions at chip-enabled terminals

- Contactless payment capability allows secure tap-to-pay transactions without swiping or inserting card

- Virtual card numbers for online shopping protect your actual card number from merchant data breaches

- Transaction alerts via email or SMS notify you instantly of card usage for immediate fraud detection

- Card lock feature in mobile app temporarily disables card if misplaced preventing unauthorized use

- Two-factor authentication for online banking login adds extra security layer beyond password

Fraud Response Process

If you identify unauthorized transactions or suspect fraud, immediate action minimizes potential losses and expedites resolution.

- Report suspected fraud immediately by calling number on back of card or through mobile app

- Review recent transactions identifying all unauthorized charges for dispute filing

- Request new card with different number preventing additional fraudulent charges

- File police report for identity theft if fraud extends beyond single transaction

- Monitor credit reports for new accounts or inquiries resulting from compromised information

- Update automatic payments and saved payment methods with new card information once received

Comparing PenFed Cards to Competitor Options

Evaluating PenFed credit cards against offerings from major banks and other credit unions helps you make informed decisions about which card provides the best overall value for your specific financial situation and spending patterns.

PenFed’s competitive advantage often lies in the combination of generous rewards, exceptionally low interest rates, and absence of common fees rather than any single standout feature. While some bank cards offer higher rewards in specific categories, they typically charge annual fees or higher interest rates offsetting the additional rewards for many users.

Competitive Analysis

- PenFed Power Cash 1.5% cashback competes directly with Citi Double Cash and Capital One Quicksilver

- Interest rates typically five to ten percentage points lower than comparable bank credit cards

- No balance transfer fees save hundreds of dollars compared to typical three to five percent fees

- Customer service reputation consistently ranks above major banks with personal member-focused approach

- Credit union structure means profits benefit members through better rates rather than shareholders

| Card Feature | Key Benefit |

|---|---|

| Low Interest Rates | APR often starts around 10% significantly lower than typical bank cards |

| No Balance Transfer Fees | Save hundreds on debt consolidation compared to standard 3-5% fees |

| Competitive Rewards | 1.5% cashback or 5X points on gas matches or beats major bank offerings |

| Member Benefits | Access to competitive loans mortgages and savings products beyond credit cards |

Frequently Asked Questions

No, military affiliation is not required for PenFed membership. While originally serving military members, PenFed has expanded eligibility to include civilians nationwide. Anyone can join by becoming a member of a qualifying association like National Military Family Association for a small one-time donation, typically around twenty dollars, granting full access to all PenFed products including credit cards.

PenFed typically requires good to excellent credit for approval, generally meaning credit scores of 700 or higher for their rewards cards. However, requirements vary by card product, and factors beyond credit score including income, employment history, and existing debt influence approval decisions. PenFed may offer lower credit limits or different card products to applicants with scores in the mid-600s demonstrating responsible credit management.

Yes, most PenFed credit cards allow balance transfers, and notably, PenFed typically charges no balance transfer fees, saving you three to five percent compared to most other cards. Combined with their low interest rates often around ten to twelve percent, PenFed cards excel for consolidating high-interest credit card debt. Request balance transfers during application or after approval through online banking or customer service.

PenFed mails approved credit cards within seven to ten business days to your registered address. Expedited shipping may be available for urgent needs by contacting customer service. Once received, activate your card through online banking or the phone number provided with the card. For immediate access to your account information and to begin setting up payments, log into online banking where your new account appears even before the physical card arrives.

Most PenFed credit cards charge no foreign transaction fees, making them excellent for international travel and purchases. This saves you three percent on every purchase compared to cards charging foreign transaction fees. However, currency conversion rates still apply, and international ATM withdrawals may incur fees from the ATM operator. Always notify PenFed of travel plans to prevent security holds on your card during international use.

Conclusion

PenFed credit cards deliver exceptional value through competitive rewards programs, industry-leading low interest rates, and comprehensive member benefits that often surpass traditional bank offerings. The straightforward application process combining credit union membership with card approval provides access to financial products designed with member interests rather than shareholder profits as the primary focus.

Whether you prioritize cashback simplicity with the Power Cash Rewards card, category-specific earning with the Platinum Rewards option, or low interest rates for balance transfers, PenFed offers solutions for diverse financial needs. The small effort required to establish credit union membership through association membership unlocks lasting benefits extending beyond credit cards to include competitive auto loans, mortgages, and savings products. For individuals seeking credit cards that balance generous rewards with low costs and exceptional customer service, PenFed membership represents a valuable financial decision providing benefits that compound over years of membership.