Wells Fargo Active Cash Card: Complete Application Guide

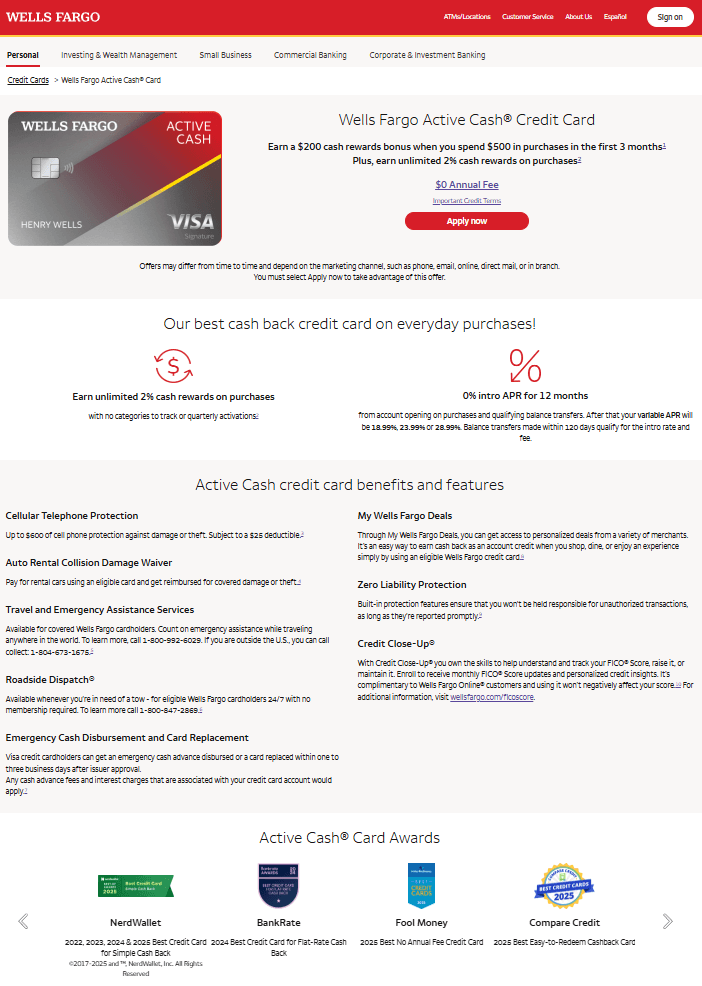

The Wells Fargo Active Cash Card is one of the best cash back credit cards available today. It offers 2% unlimited cash back on all purchases with no annual fee. This guide shows you exactly how to apply, what you’ll get, and how to maximize your rewards.

Advertisement

How to Apply for Wells Fargo Active Cash Card

Applying for the Active Cash Card is quick and straightforward. Most people get approved instantly online. You can start earning cash back right away with a virtual card while waiting for your physical card to arrive.

Advertisement

What You Need to Qualify

You need good to excellent credit to get approved. Here’s what Wells Fargo looks for:

Credit Score: You should have a FICO Score of 670 or higher. Scores above 700 have the best approval chances.

Anúncios

Age: You must be at least 18 years old.

Income: You need steady income from employment, self-employment, or other verifiable sources. There’s no specific minimum, but you must show you can handle credit card payments.

Documentation: You’ll need a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

U.S. Address: You must provide a physical street address in the United States. P.O. boxes don’t work.

Six-Month Rule: You can’t get this card if you opened another Wells Fargo credit card in the past six months.

Check Your Pre-Qualification First

Before you apply, use Wells Fargo’s pre-qualification tool. It won’t hurt your credit score and shows your approval chances. You’ll see which cards you qualify for and what APR you’d get.

Go to the Wells Fargo website, enter your name, address, and last four digits of your Social Security Number. If you’re already a Wells Fargo customer, log in for personalized results. This step takes two minutes and saves you from unnecessary credit inquiries.

Apply Online in Minutes

Here’s the exact process to apply:

Step 1: Go to wellsfargo.com and find the Active Cash Card page.

Step 2: Click “Apply Now” on the card page.

Step 3: Fill in your personal information – full name, date of birth, SSN, address, phone, and email.

Step 4: Add your employment details, employer name, annual income, and monthly housing payment.

Step 5: Read the terms and conditions carefully. Check the interest rates and fees.

Step 6: Submit your application.

Step 7: Get your decision. Most people know immediately if they’re approved. If not, you’ll hear back within 7 business days.

You can check your application status anytime by calling (800) 967-9521.

Other Ways to Apply

You don’t have to apply online. Here are your options:

Mobile App: Download the Wells Fargo app and apply from your phone.

In Person: Visit any Wells Fargo branch and apply with a banker who can answer your questions.

By Mail: Request a paper application, though this takes the longest.

When You’ll Get Your Card

If approved instantly, you get a virtual card number immediately. Use it online while waiting for your physical card. The physical card arrives in 7-10 business days by mail.

You must activate your card before using it. Activate online, through the app, or call the number on the card. Activation takes just minutes.

Main Benefits of Wells Fargo Active Cash Card

This card delivers real value through straightforward benefits. You don’t need to track categories or activate bonuses. Every purchase earns the same reward automatically.

Unlimited 2% Cash Back

You earn 2% cash back on every purchase. No exceptions. No limits. No categories to remember.

Buy groceries, gas, clothes, electronics, or pay bills – you always get 2% back. If you spend $2,000 monthly, that’s $480 cash back yearly. Your cash back never expires as long as your account stays open.

Most other flat-rate cards only give 1.5% or less. That extra 0.5% adds up to real money over time.

No Annual Fee

You pay $0 in annual fees. Ever. Many reward cards charge $95-$450 yearly. With the Active Cash, you keep all your cash back without fees eating into it.

This makes it perfect for keeping long-term, even if it becomes your backup card later.

$200 Welcome Bonus

New cardholders get $200 cash back after spending $500 in the first three months. That’s easy to hit – just $167 per month.

Use the card for normal expenses like groceries and gas, and you’ll reach $500 naturally. Combined with the 2% you earn on that spending, you get $210 total in rewards right away.

0% APR for 12 Months

Pay zero interest on purchases and balance transfers for your first 12 months. After that, the APR is 18.99%, 23.99%, or 28.99% based on your credit.

This helps if you need to make a big purchase and pay it off over time. Or transfer high-interest debt from other cards and save on interest while paying it down.

Balance transfers must happen within 120 days of opening your account to get the 0% rate. The transfer fee is 3% (minimum $5) for the first 120 days, then up to 5% after.

Cell Phone Protection

Pay your monthly phone bill with this card and get automatic protection. If your phone gets damaged, stolen, or lost, you’re covered up to $600 per claim with a $25 deductible.

You can file two claims every 12 months. This saves you hundreds on phone repairs or replacements.

Visa Signature Perks

You get premium benefits as a Visa Signature cardholder:

24/7 Concierge Service: Get help booking restaurants, buying event tickets, planning trips, and more.

Luxury Hotel Benefits: Access special perks at select premium hotels worldwide.

Travel Assistance: Emergency help anywhere in the world, including card replacement and cash access.

Auto Rental Coverage: Skip expensive rental car insurance when you use your card to rent.

Roadside Help: Towing, flat tire service, jump starts, and lockout assistance.

Fees and Charges

Here’s every fee you need to know about. Most are easy to avoid with smart card use.

Annual Fee

$0. There’s no annual fee now or ever.

Interest Rates (APR)

After your 12-month promotional period, you’ll pay 18.99%, 23.99%, or 28.99% variable APR on purchases. Your rate depends on your credit when you apply.

Cash advances have higher rates and start charging interest immediately with no grace period. Avoid cash advances – they’re expensive.

Pay your full balance every month to avoid all interest charges.

Balance Transfer Fee

Transfers within the first 120 days cost 3% of the amount (minimum $5). After 120 days, the fee jumps to 5% (minimum $5).

Despite the fee, transferring high-interest debt often saves you money compared to keeping it on expensive cards.

Cash Advance Fee

Taking cash advances costs $10 or 5% of the amount, whichever is greater. Plus you pay immediate interest. Don’t use this feature unless it’s an absolute emergency.

Foreign Transaction Fee

You pay 3% on all purchases made outside the U.S. or in foreign currencies. This includes shopping on international websites.

If you travel abroad often, consider getting a second card with no foreign fees for those trips.

Late Payment Fee

Miss a payment and you’ll pay up to $29, or your minimum payment amount, whichever is less. Late payments also hurt your credit score.

Set up automatic payments or payment reminders to avoid this fee completely.

How Cash Back Works

The rewards program is dead simple. Spend money, get 2% back. That’s it.

Earning Rewards

Every dollar you spend earns 2 cents cash back. You earn rewards on virtually everything: groceries, gas, dining, shopping, bills, subscriptions – all of it gets 2%.

Your rewards post within a day or two after each purchase. Track them anytime through your online account or mobile app.

There’s no cap on earnings. No categories to activate. No hoops to jump through. Just consistent 2% cash back automatically.

Your rewards never expire as long as your account stays open and in good standing.

Redeeming Your Cash Back

You have multiple ways to use your rewards:

Statement Credit: Apply cash back to your card balance. This reduces what you owe.

Bank Deposit: Transfer rewards directly to your Wells Fargo checking or savings account as cash.

ATM Withdrawal: Get cash in $20 increments from Wells Fargo ATMs using your debit card.

Check by Mail: Wells Fargo mails you a paper check for your rewards amount.

Rewards Portal: Trade cash back for gift cards, merchandise, or travel. Though cash usually gives you the best value.

Tips to Maximize Your Benefits

Get the most from your card with these strategies:

Always Pay in Full

Pay your entire statement balance every month by the due date. This avoids interest charges that would wipe out your rewards. A $1,000 balance at 24% APR costs you $20 monthly in interest – more than the rewards you’d earn.

Paying in full also keeps your credit utilization low, which improves your credit score.

Use It for Everything

Since you earn 2% on all purchases, put every possible expense on this card. Groceries, gas, utilities, insurance, subscriptions, dining, shopping – everything.

Even small purchases add up. Your daily coffee, lunch, parking – it all earns cash back that compounds over time.

Pair with Category Cards

If you have cards that earn 3% or more in specific categories, use those cards for those purchases. Use the Active Cash for everything else where you’d only earn 1-1.5% with other cards.

Keep it simple – two or three cards maximum. You want rewards without complexity.

Use the 0% APR Wisely

Planning a big purchase? Buy during your first year and spread payments over 12 months interest-free. Just make sure you pay it off completely before the promotional period ends.

Transferring high-interest debt? Calculate the transfer fee against the interest you’ll save. Usually it’s worth it, but do the math.

Set Up Autopay

Configure automatic payments for at least the minimum amount. This prevents late fees and protects your credit score.

Better yet, set up autopay for the full balance if you consistently track your spending and maintain enough money in your bank account.

Monitor Your Account Weekly

Check your account every week or two. Spot unauthorized charges quickly. Track your spending patterns. Verify rewards post correctly.

Wells Fargo gives you free FICO Score access – check it regularly to watch your credit health improve.

Active Cash vs Other Cards

Here’s how the Active Cash compares to popular alternatives:

vs. Citi Double Cash

Both offer 2% cash back, but the Citi Double Cash is more complicated – you earn 1% when you buy and 1% when you pay. The Active Cash gives you the full 2% immediately.

The Active Cash has a $200 welcome bonus. Citi Double Cash usually has no bonus. The Active Cash offers 0% APR on purchases for 12 months. Double Cash only offers 0% on balance transfers (18 months) but not purchases.

The Active Cash includes cell phone protection and Visa Signature benefits. Double Cash doesn’t. Overall, the Active Cash delivers better value for most people.

vs. Capital One Quicksilver

Quicksilver earns just 1.5% on everything – less than the Active Cash’s 2%. On $20,000 annual spending, that’s $100 less cash back.

But Quicksilver has no foreign transaction fees, making it better for international travel. It also gives 5% on hotels and car rentals booked through Capital One Travel.

For domestic spending, the Active Cash wins easily. For frequent travelers, consider having both.

vs. Chase Freedom Unlimited

Freedom Unlimited earns 3% on dining and drugstores, 1.5% on everything else. If you spend heavily in those 3% categories, you might earn more with this card.

The big advantage is Chase’s Ultimate Rewards program. If you have Chase Sapphire cards, you can transfer points to airlines and hotels for potentially huge value.

The Active Cash is simpler and better for straightforward cash back. Freedom Unlimited is better if you want to optimize within Chase’s ecosystem.

Final Thoughts

The Wells Fargo Active Cash Card is an excellent choice if you want simple, valuable rewards without fees or complications. You get 2% cash back on everything, a solid welcome bonus, and useful benefits – all with no annual fee.

The application process is fast. Most people get instant approval and can start using a virtual card immediately. If you have good credit and want a reliable cash back card, this is a top choice.

Use it responsibly. Pay your balance in full every month. Make payments on time. Use credit as a tool, not a burden. The Active Cash’s benefits work best when combined with smart financial habits.

Check your pre-qualification first to see your approval odds without hurting your credit. When you’re ready, apply online and start earning unlimited 2% cash back on every purchase you make.