Complete guide to the Wisely Card: benefits and how to apply

Wisely Card is a prepaid payroll card solution offered by ADP that provides employees with direct deposit alternatives, featuring no monthly fees, cashback rewards, early pay access, and comprehensive money management tools through a mobile app. Wisely Card represents a modern approach to payroll management and personal finance, offering employees an alternative to traditional bank accounts for receiving wages and managing money.

Advertisement

Developed by ADP, one of the leading payroll processing companies, this prepaid card solution eliminates common banking barriers while providing robust features including cashback rewards, bill pay capabilities, and early access to paychecks. Understanding how Wisely Card works and its benefits helps employees make informed decisions about their payroll options.

Advertisement

Step-by-Step Guide: How to Apply for Wisely Card

Before starting the Wisely Card application process, ensure you meet the basic requirements and have the necessary information ready. This preparation streamlines the application and reduces potential delays. Applying for the Wisely Card is a straightforward process designed specifically for employees whose companies partner with ADP for payroll services.

Unlike traditional bank accounts or credit cards that require extensive credit checks and documentation, the Wisely Card application focuses on simplicity and accessibility, making it available to virtually all employees regardless of banking history or credit status. The process begins with your employer and concludes with card activation, typically taking seven to ten business days from enrollment to first use.

Anúncios

Step-by-Step Application Process

- Verify Employer Participation: Contact your Human Resources department or payroll administrator to confirm that your employer offers Wisely as a payroll option and request enrollment instructions specific to your company.

- Complete Enrollment Form: Access the enrollment form through your employer’s HR portal or request a paper application, then provide your full legal name, Social Security Number, date of birth, current residential address, mobile phone number, and email address ensuring all information matches your official documents.

- Submit Required Documentation: Depending on your employer’s requirements, you may need to provide a copy of your government-issued photo ID such as a driver’s license or passport and proof of address like a utility bill or lease agreement.

- Wait for Card Delivery: After application approval, your Wisely Card will be manufactured and mailed to your registered address within seven to ten business days, arriving in a white envelope with The Bancorp Bank or ADP branding.

- Download myWisely App: Before activating your card, download the official myWisely mobile app from the App Store for iPhone or Google Play Store for Android devices, verifying the developer is listed as ADP Inc.

- Activate Your Card: Open the myWisely app, tap “Activate Card,” and enter your sixteen-digit card number, three-digit security code from the back, expiration date, and last four digits of your Social Security Number for verification.

- Create Account Credentials: Set up a username and strong password with at least eight characters including uppercase, lowercase, and numbers, then enable biometric login using fingerprint or face recognition for future convenience.

- Set Your PIN: Choose a four-digit Personal Identification Number that is memorable but not easily guessed, avoiding obvious numbers like 1234 or your birth year, and enter it twice to confirm.

- Complete Profile Setup: Verify your email address by clicking the confirmation link sent to your inbox, confirm your mobile phone number via SMS verification code, and configure notification preferences for deposits and purchases.

- Link Direct Deposit: Access your direct deposit information within the myWisely app showing your routing number and account number, then provide these numbers to your employer’s payroll department to begin receiving paychecks directly to your Wisely Card.

Comparing to Traditional Banking

Traditional bank accounts often come with hidden costs that accumulate over time. Monthly maintenance fees, overdraft charges, and minimum balance requirements can drain hundreds of dollars annually from your account. Wisely Card eliminates overdraft fees entirely since you can only spend available funds, preventing the cascade of charges that plague many checking account holders.

Check cashing services charge two to five percent of check value, meaning a five hundred dollar paycheck costs ten to twenty-five dollars to cash. Over a year, these fees total several hundred dollars that Wisely users keep by receiving free direct deposits. This cost savings alone justifies choosing Wisely for many workers, especially those living paycheck to paycheck where every dollar matters.

Mobile App Features and Money Management Tools

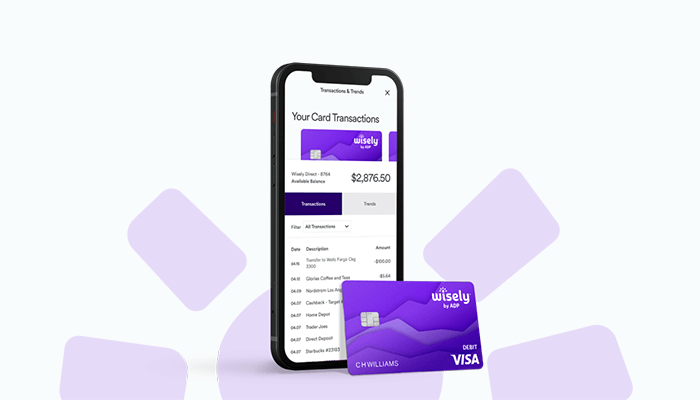

The myWisely mobile app serves as command center for your financial life, offering features that rival or exceed traditional banking apps. The intuitive interface makes checking balances, reviewing transactions, and paying bills simple even for users uncomfortable with technology.

Real-time transaction notifications provide immediate awareness of account activity, helping detect fraud quickly and stay informed about spending patterns. The transaction history displays with clear descriptions and categories, making it easy to track where money goes each month without manual record keeping.

Budgeting and Savings Tools

Built-in budgeting features help users take control of their finances by setting spending limits in different categories. The app tracks spending against these budgets automatically, sending alerts when approaching or exceeding category limits. This awareness helps modify spending behavior and avoid overspending in areas like dining out or entertainment.

- Automatic expense categorization sorts transactions into spending categories for easy budget tracking

- Savings goals feature lets you set aside money for specific purposes with progress tracking and visual motivation

- Bill payment reminders ensure you never miss due dates avoiding late fees and service interruptions

- Spending insights show monthly spending trends helping identify areas for potential savings and budget adjustments

Security Features

Security remains paramount in the myWisely app with multiple layers protecting your account. Biometric authentication using fingerprint or face recognition provides quick secure access while preventing unauthorized users from opening your app. You can instantly lock your card through the app if it’s lost or stolen, preventing fraudulent transactions while you arrange for a replacement.

Transaction alerts serve double duty as both convenience and security features. Receiving immediate notifications for every transaction means you’ll know within seconds if someone uses your card without authorization, allowing immediate action to protect your funds. The app also allows setting spending limits and restricting transaction types, providing customized security matching your risk tolerance.

Using Your Wisely Card for Daily Transactions

Wisely Card functions like any major debit card, accepted at millions of locations worldwide wherever Visa debit cards are accepted. This universal acceptance means you can shop online, in stores, pay bills, and handle virtually any transaction without needing a traditional bank account.

Online shopping works seamlessly with Wisely Card by entering the card number, expiration date, and security code just like any credit or debit card. The card protects online purchases with zero liability fraud protection, meaning you’re not responsible for unauthorized transactions if someone steals your card information.

Bill Payment Options

Paying bills with your Wisely Card offers flexibility through multiple methods. Use the card directly for automatic bill payments with utilities, phone companies, and subscription services. The myWisely app includes bill pay functionality for sending payments to companies or individuals, eliminating the need for checks or money orders.

- Set up automatic recurring payments for regular bills ensuring on-time payment every month

- Schedule one-time payments in advance matching bill due dates with your pay schedule

- Pay individuals through the app using their phone number or email for rent, services, or personal payments

- Track payment history within the app for easy record keeping during tax time or budget reviews

Cash Access

Despite being a prepaid card, Wisely provides easy cash access when needed. Use the ATM locator in the myWisely app to find thousands of fee-free ATMs near your current location. The network includes major retailers like CVS, Walgreens, and 7-Eleven, making free cash withdrawal convenient regardless of where you are.

Cash back at point of sale offers another way to get cash without ATM fees. Many retailers allow requesting cash back during debit transactions, adding the amount to your purchase total and receiving cash from the register. This method provides free cash access during routine shopping trips without seeking out specific ATMs.

Customer Support and Problem Resolution

Wisely provides multiple customer support channels ensuring help is available when you need it. The customer service number operates twenty-four hours daily, seven days weekly, providing human assistance regardless of time zone or work schedule. Representatives can help with everything from lost cards to transaction disputes and technical issues with the app.

The myWisely app includes robust self-service features resolving many common issues without contacting support. Lock or unlock your card instantly, dispute transactions, update personal information, and access FAQ sections all within the app. This immediate access to solutions proves more convenient than waiting on hold for many routine matters.

Dispute Resolution

If you identify an unauthorized or incorrect transaction, the dispute process through Wisely follows clear steps protecting your rights. Report the transaction through the app or by calling customer service within sixty days of the transaction appearing on your statement. Provide details about why you’re disputing the charge and any supporting documentation you have.

- Provisional credit may be issued to your account while the investigation proceeds depending on circumstances

- Investigation timeline typically completes within ten business days for most disputes with updates provided

- Zero liability protection means you’re not responsible for fraudulent charges if you report them promptly

- Final determination letter explains the investigation results and any permanent credits or debits to your account

Lost or stolen card reporting must happen immediately to minimize liability and prevent unauthorized use. The lock card feature in the app provides instant protection while you’re searching for a misplaced card. If you determine the card is truly lost or stolen, request a replacement through the app or customer service receiving a new card within seven to ten business days.

| Feature | Benefit |

|---|---|

| No Monthly Fees | Keep your full paycheck without maintenance charges or minimum balance requirements |

| Cashback Rewards | Earn up to 5% back on purchases at participating merchants automatically |

| Early Pay Access | Receive your paycheck up to two days early for better financial flexibility |

| Mobile App | Comprehensive money management tools with budgeting and savings features |

Frequently Asked Questions

No, Wisely Card does not require a traditional bank account. It functions as a standalone prepaid card account receiving direct deposits from your employer. This makes it ideal for individuals who are unbanked or underbanked, providing access to modern financial tools without needing to establish a relationship with a traditional bank or credit union.

Yes, Wisely Card does not require a credit check for approval. Since it’s a prepaid card using your own deposited funds rather than extending credit, your credit history is irrelevant to eligibility. This accessibility makes Wisely an excellent option for individuals rebuilding credit or those who have been denied traditional bank accounts due to past banking issues.

Beyond employer direct deposits, you can add money through mobile check deposit using the myWisely app, transfer funds from linked bank accounts, receive payments from other Wisely cardholders, or deposit cash at participating retail locations. Tax refunds and government benefits can also be directly deposited to your Wisely Card using the routing and account numbers provided in the app.

Yes, Wisely Card funds are FDIC insured up to $250,000 through The Bancorp Bank, Member FDIC. This provides the same federal protection as traditional bank accounts. Additionally, Visa’s zero liability policy protects you from unauthorized transactions when reported promptly. The card includes security features like instant card locking, biometric app access, and real-time transaction alerts for comprehensive protection.

Yes, Wisely Card works internationally wherever Visa debit cards are accepted. The card does not charge foreign transaction fees, making it cost-effective for international purchases online or while traveling abroad. However, currency conversion rates apply, and ATM operators in other countries may charge their own access fees. Check the myWisely app for current international usage policies before traveling.

Conclusion

Wisely Card offers a comprehensive financial solution for employees seeking alternatives to traditional banking with modern features that promote better money management. The combination of no monthly fees, cashback rewards, early pay access, and robust mobile app functionality provides real value for users at all income levels. The straightforward application process and lack of credit checks make it accessible to virtually all workers regardless of banking history.

For individuals frustrated with traditional banking fees or those who have struggled to maintain bank accounts, Wisely presents a viable path to financial inclusion with dignity and convenience. The card’s security features, customer support availability, and FDIC insurance provide peace of mind while the budgeting tools and savings features help users build better financial habits. Whether you’re looking to eliminate banking fees, earn rewards on everyday purchases, or simply gain better control over your finances, Wisely Card delivers a modern, user-friendly solution that puts you in control of your money.