Learn how to apply for the Citi Rewards Mastercard

Looking to get more out of your everyday spending? Searching for a credit card that brings flexibility and a host of benefits? The Citi Rewards Mastercard might just be the answer you’ve been looking for. But what sets this card apart from the rest, and why should it be a go-to in your wallet?

Advertisement

In this article, you’ll discover how to apply for the Citi Rewards Mastercard, learn about the perks it offers, and explore the standout features that make it a smart choice for savvy spenders. Whether you’re curious about the rewards program or the card’s worldwide acceptance, you’ll find all the details you need right here.

Advertisement

How to apply for the Citi Rewards Mastercard

Applying for the Citi Rewards Mastercard is easy and can be done online or at a branch. Here’s how you can do it:

- Go to the Citi website to start your application, (www.citi.com);

- Provide your personal details like name, address, and job information. Make sure everything is correct to avoid delays;

- Take time to read the terms and conditions. Knowing the fees, interest rates, and rewards is crucial. This will help you decide if this card is right for you;

- After reviewing, submit your application. Sometimes you get a decision right away, or it might take a few days.

Once you submit, watch for updates via email or phone. If approved, your new Citi Rewards Mastercard will arrive in the mail soon.

Anúncios

Requirements to apply for the Citi Rewards Mastercard

Before you begin, double-check that you have everything you need on hand. You’ll generally require:

- Your ID: This could be a driver’s license or a passport.

- Proof of Income: Have recent pay stubs or tax returns ready.

- Social Security Number: This is essential for identity verification.

Card Benefits

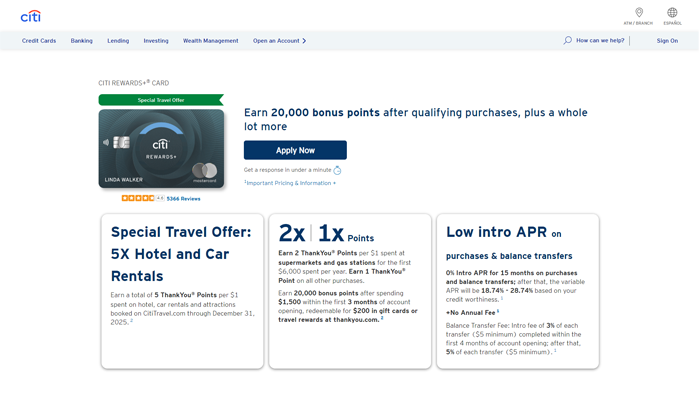

The Citi Rewards Card is a great choice for anyone wanting to make the most out of their spending. This card offers several perks that make everyday purchases more rewarding. Let’s explore what makes this card special:

- Earn Reward Points: Every time you use your Citi Rewards Mastercard, you earn points. Whether you’re buying groceries or dining out, these points can be redeemed for exciting rewards like gift cards, travel, and more. It’s like getting a bonus for doing your regular shopping!

- Travel Benefits: If you enjoy traveling, you’ll love this card. It gives you extra points on travel-related purchases, such as flights and hotels. Imagine earning free flights or hotel stays just by using your card while exploring new places.

- Cash Back Offers: Occasionally, Citi offers cash back deals on certain categories. By taking advantage of these, you can get some money back on your purchases. It’s a simple way to save while you spend.

- Special Access to Events: With this card, you might get exclusive access to concerts, events, and unique experiences. It adds a touch of excitement and exclusivity to owning the card.

- No Expiration on Points: Unlike some other programs, your Citi Rewards points don’t expire as long as your account is active. This means you can save your points for something special without worrying about losing them.

These benefits make the Citi Rewards Mastercard more than just a card; it becomes a tool to enrich your lifestyle. Consider using it to turn your everyday spending into valuable rewards. Are you ready to start earning while you shop?

Coverage and Acceptance Network

The Citi Rewards Mastercard is a great choice for anyone who travels or shops online. It’s accepted nearly everywhere, which means you can use it at your favorite stores, restaurants, and online shops around the world. Imagine you’re on a vacation in Paris, sipping coffee at a café. You can pay with your Citi Rewards Mastercard without worrying if they’ll accept it.

It’s part of the Mastercard network, which is one of the most widely accepted payment networks globally. This means less stress and more fun while you travel. A big plus is that you don’t need to carry a lot of cash. This can be a lifesaver, keeping you safe from theft or loss. Plus, you avoid the hassle of dealing with currency exchange rates. You can just swipe your card, and you’re good to go!

What is the interest rate?

The Citi Rewards Mastercard currently offers a variable interest rate (APR) that ranges between 19.74% and 29.74%, depending on your creditworthiness and market conditions. This rate applies after any introductory periods have ended.

For new purchases and balance transfers, the card may offer an introductory 0% APR for a set period, but it’s important to be aware of when this promotional rate ends and the standard variable APR begins. Always check the specific terms provided in your card agreement, as rates can fluctuate based on various factors.

Does the card have an annual fee?

The Citi Rewards Mastercard has an annual fee of $196.20, including GST. However, Citibank often offers a waiver for the first year, allowing cardholders to avoid this fee initially. After the first year, you can request an annual fee waiver, which is typically granted, especially if you maintain good spending habits on the card. This makes the Citi Rewards Mastercard a relatively cost-effective option for those looking to earn rewards on their purchases.

How to get in touch

To get in touch with Citi Rewards Mastercard customer service, you have several options. You can call their general support number at 1-800-950-5114 for assistance. Alternatively, you can visit their official website or use the Citi Mobile App to send a message or chat with a representative online.

For those who prefer traditional mail, correspondence can be sent to Citibank Customer Service, P.O. Box 6500, Sioux Falls, SD 57117( Citi , WalletHub ).

We’ve covered a lot about the Citi Rewards Mastercard, from how to get it to the great perks it offers. If you want a card that gives you rewards for your everyday spending, this is a solid choice. It can help you make the most out of your purchases and manage your finances better.

Are you ready to start earning rewards with the Citi Rewards Mastercard? Think about how this card can turn your daily purchases into exciting benefits. Take a moment to explore your options and see if you’re ready to apply today! What rewards do you want to earn, and how can this card help you achieve them?