Advantages and benefits of applying for the United Gateway Visa

Looking for a credit card that fits perfectly with your travel lifestyle? Ever wondered what sets the United Gateway Visa apart from other travel cards? If these thoughts have crossed your mind, you’re about to uncover some interesting insights.

Advertisement

This article dives into the United Gateway Visa, showing you how to apply and the qualifications needed. It highlights a wide range of benefits that come with the card, ensuring you get the most out of it. You’ll also discover key details about where the card is accepted and its extensive coverage. Plus, get a clear understanding of its fees and interest rates. Curious if this card is the perfect match for you? Keep reading to find out more.

Advertisement

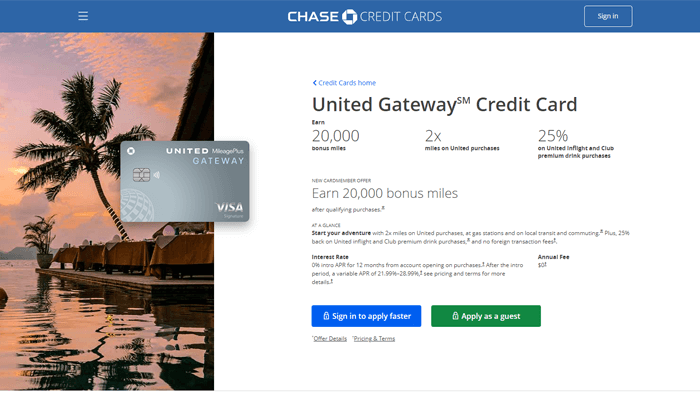

How to Apply for the United Gateway Visa Card

Getting started with applying for the United Gateway Chase Visa isn’t as complicated as it might seem. Let’s walk through the process step by step, making it as easy as possible for you. Whether you prefer doing things online or offline, there’s a method for you.

Online Application: This is the quickest and easiest way to apply. Here’s how you can do it:

Anúncios

- Head over to the United Gateway Visa webpage, (creditcards.chase.com).

- Fill in the details like your name, address, and income. Make sure everything is correct to avoid delays.

- Once you’ve reviewed your information, hit submit. You’ll get a confirmation that your application is received.

Offline Application: Prefer the traditional way? No problem. Here’s what you need to do:

- Find a Branch: Look for a bank branch that offers the United Gateway Visa. A quick search online or a call can help you find one.

- Fill Out a Paper Form: Request a form at the branch, fill it out with the necessary details, and make sure it’s all correct.

- Submit Your Form: Hand your completed application to a bank representative or mail it to the provided address.

Tips for a Smooth Application: Want to boost your chances of approval? Here are some handy tips:

- Check Your Credit Score: Knowing your score can help you understand your chances. A higher score often means better chances.

- Prepare Your Documents: Gather things like proof of income and ID. It saves time during the process.

- Be Honest: Always provide truthful information. It helps avoid issues during verification.

After submitting your application, you usually get a decision in a few days. If you’re approved, your new card will arrive in the mail soon. Take a moment to think about what you’re looking forward to most with your new card.

Requirements to apply for the card

Thinking about getting the United Gateway Visa? Let’s make sure you’re on the right track! There are a few key things you’ll need to have or consider before applying. Knowing these can help you feel prepared and boost your chances of getting approved.

- Credit Score: A good score is usually a must. Aim for at least 650. This shows you manage credit well and can be trusted with more. Have you checked your score lately?

- Income Level: Your income matters because it shows you can pay off what you owe. This could be from a job, freelance work, or other sources. Do you feel secure with your current earnings?

- Age Requirement: You need to be 18 or older. This rule is pretty straightforward. Are you in the right age group to start enjoying this card?

- Residency Status: Being a legal resident of the U.S. is essential. Make sure you have proof ready, like a driver’s license or utility bill.

- Existing Debt Obligations: Lenders look at how much debt you already have compared to your income. A lower debt-to-income ratio can improve your chances. Is your current debt manageable?

Understanding these points can help you decide if you’re ready to apply. Make sure you have all the necessary documents and are clear on these requirements to make your application process smoother.

Card Benefits

The United Gateway Visa is great for travelers and anyone looking to get more from their spending. One of its top features is the rewards program. Every time you buy something with the card, you earn points. These points can be used for travel, which means cheaper flights or hotel stays. For example, imagine earning points every time you fill up your gas tank or buy groceries. It’s like getting free travel for doing everyday things.

Besides rewards, this card offers some neat travel perks. You might get benefits like priority boarding, free checked bags, or access to special airport lounges. Think about how nice it would be to relax in a comfy lounge instead of waiting at a crowded gate. It makes travel less of a hassle and more enjoyable.

Another big plus is the card’s focus on customer protection. It includes features like purchase protection, which helps if something you buy gets stolen or damaged, and extended warranty coverage on gadgets. So, if your new phone breaks after the regular warranty, the card could cover it. That’s a big relief!

Coverage and Acceptance Network

You’re never alone with this card. Cardholders get 24/7 customer support, which can be a lifesaver if you run into trouble while traveling. Need help in another country? Just call them anytime.

All these features make the United Gateway Visa more than just a credit card. It’s a handy tool for anyone who travels often or even just sometimes. It helps you save money and travel smarter, making every purchase count.

What is the interest rate?

When it comes to credit cards like the United Gateway Visa, understanding the interest rates and fees can help you make smarter financial choices. The interest rate, known as the Annual Percentage Rate (APR), can vary. It’s usually based on your credit score, starting around 15.99% and sometimes reaching up to 25.99%. To get the most accurate rate, it’s a good idea to check directly with the card issuer since these rates can change.

One attractive feature of many credit cards, including this one, is the introductory APR. For example, you might get a 0% APR on purchases for the first 12 months. This offers a great chance to buy big-ticket items without paying interest, as long as you clear the balance before the introductory period ends.

Does the card have an annual fee?

Another benefit of the United Gateway Visa is that it often has no annual fee. Many travel rewards cards charge annual fees of $95 or more, so having a card without that extra cost is a plus. This means you can enjoy earning rewards without an additional yearly expense.

Also, watch out for fees like late payment charges, which could go up to $39 if a due date is missed. Staying on top of payments can help you avoid these unwanted costs. Over-limit fees might apply if you spend beyond your credit limit, so it’s best to keep track of your spending.

In short, understanding the card’s interest rates, any introductory offers, and possible fees can help you use the United Gateway Visa wisely. Knowing these details ensures you get the most out of your card without incurring extra costs.

How to get in touch

To contact United Gateway Visa, you can call the United MileagePlus customer service number, which is available on the back of your card. Alternatively, you can visit the official United Gateway Visa website and use the support section to submit your queries via the contact form or online chat. If you prefer, you can also visit a United bank branch for in-person assistance. Remember to have your personal and account information ready to expedite the process.

Conclusion

Thanks for sticking with us through this article about the United Gateway Visa! We’ve covered a lot, from application details to the awesome benefits you can enjoy. This card is perfect for travelers, especially since it offers great rewards without any annual fee. That means more savings for you while you’re out exploring the world.

So, what do you think about the United Gateway Visa? Have you thought about how it can fit into your travel plans? Do you see yourself using these rewards to make your trips even more enjoyable? Take what you’ve learned and consider how this card could make your travel experiences better and more affordable. The possibilities are exciting, aren’t they?